carbon tax singapore

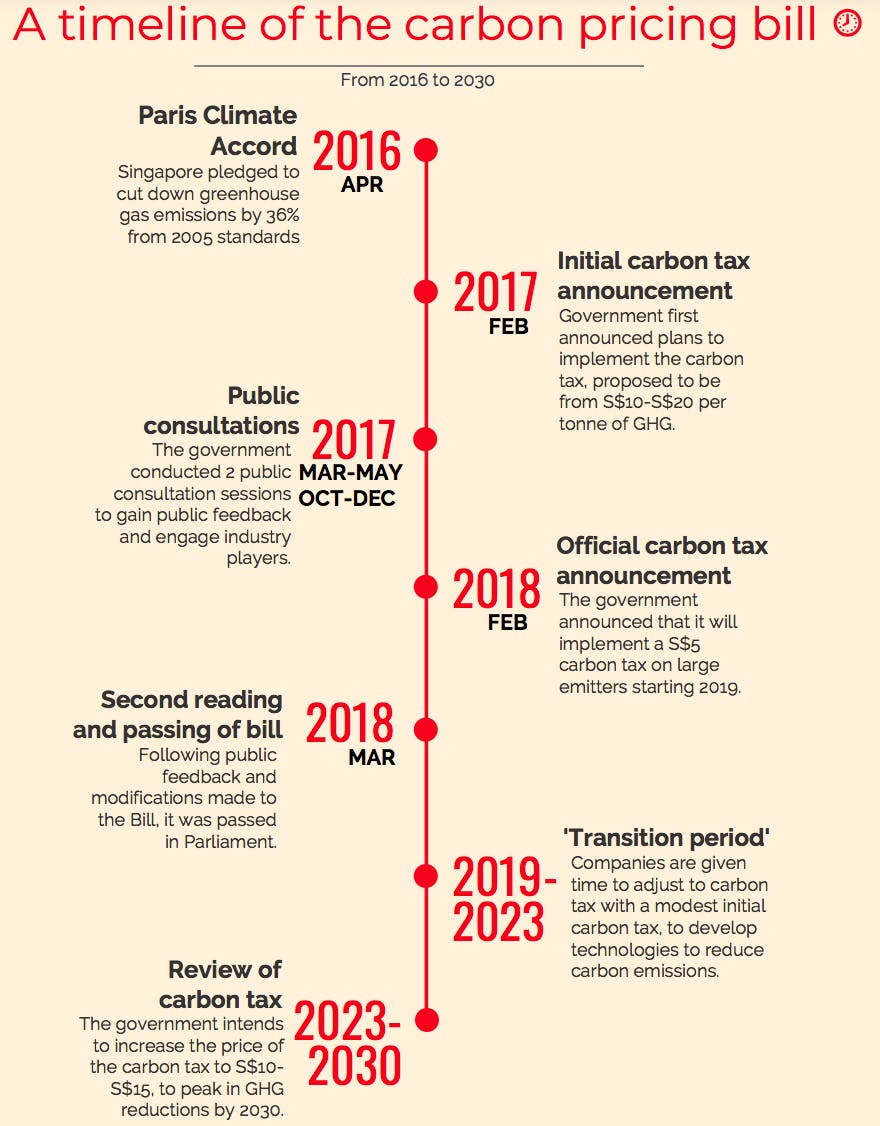

THE RIGHT PRICE FOR CARBON IN SINGAPORE The effect of a tax on effluents depends both on the tax rate and its coverage. The carbon tax level and trajectory post-2023 will be reviewed by 2022 to give time for businesses to adjust to any revision in the carbon tax trajectory.

Opinion Why Carbon Tax Is Needed And What It Means For Singapore Climate Change

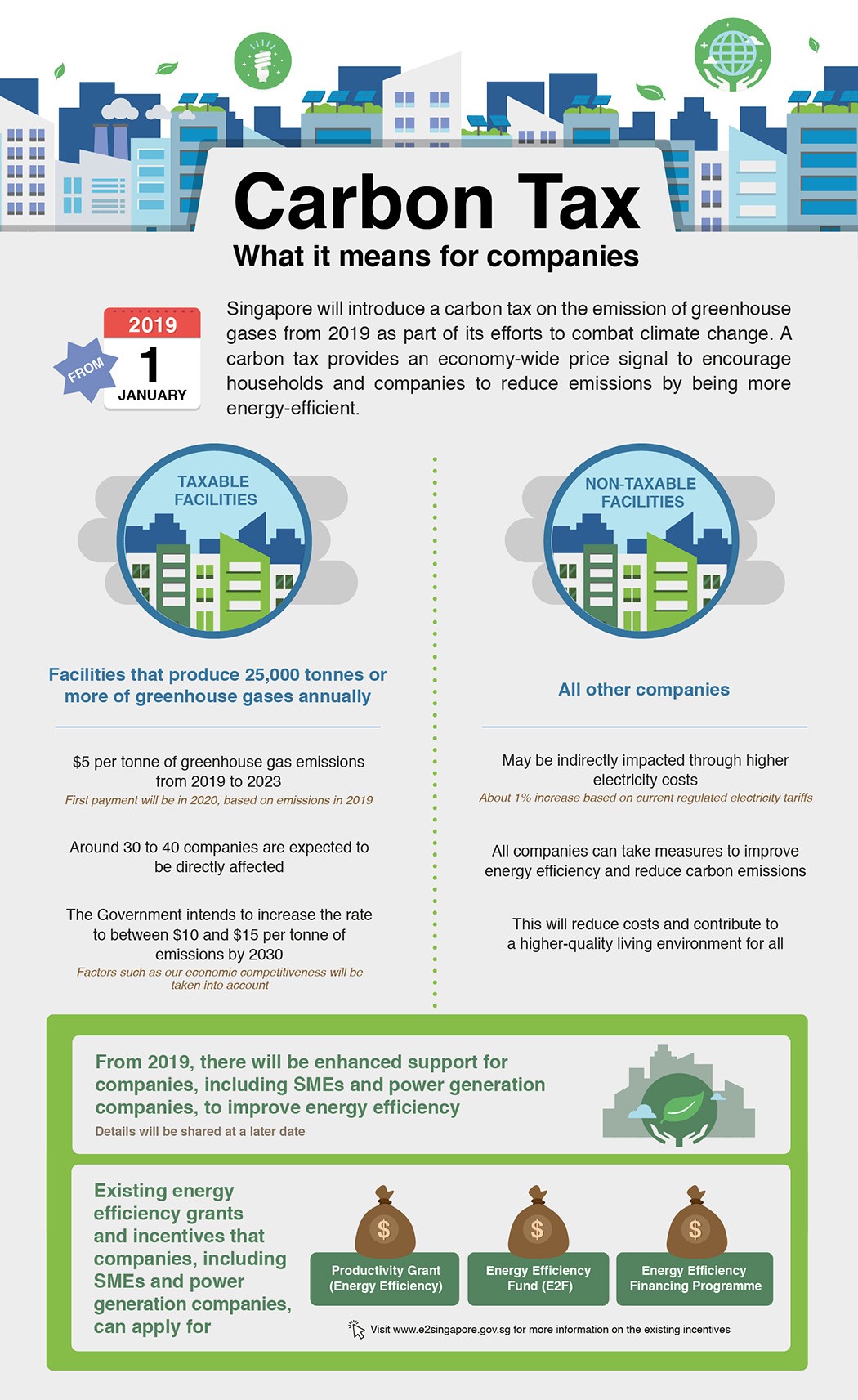

CARBON TAX Singapore implemented a carbon tax the first carbon pricing scheme in Southeast Asia on 1 January 2019.

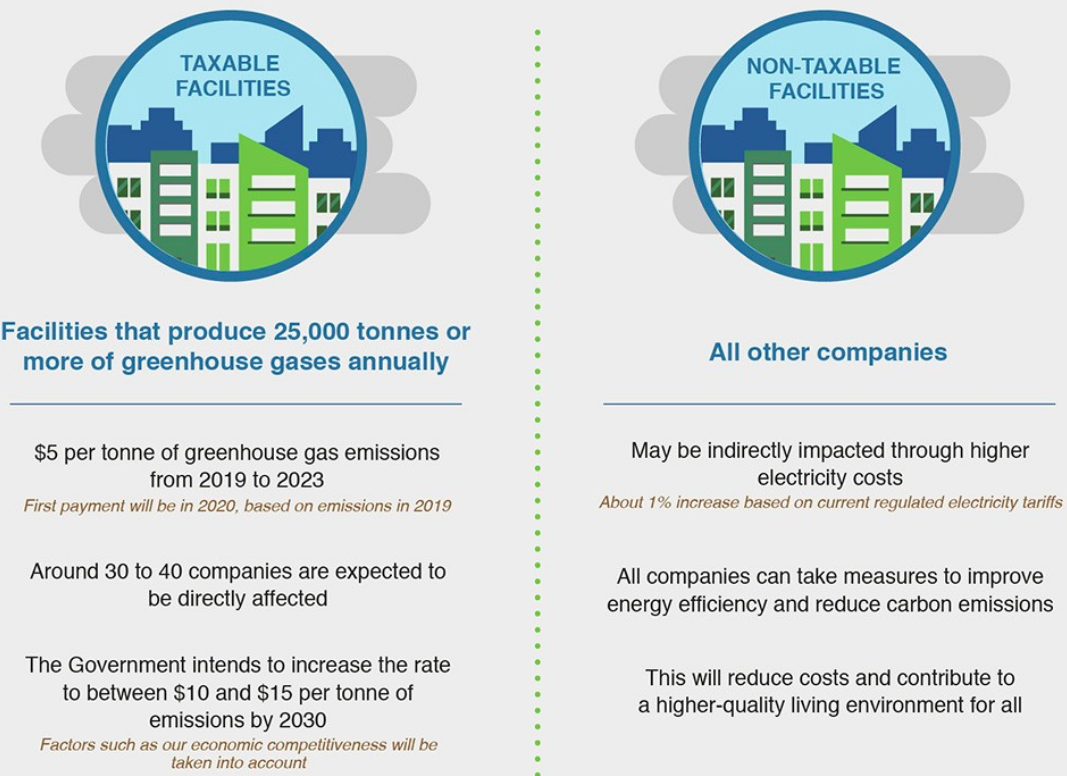

. Set at S5 per tonne of greenhouse gas emissions through 2023 Singapores carbon tax rate has been under review with the outcome to be announced in Budget 2022. 55 minutes agoSingapores carbon tax currently applies to all facilities producing at least 25000 tonnes of greenhouse gas emissions in a year. Mr Wong said the carbon price is.

Changes are also afoot for Singapores carbon tax. Singapore implemented a carbon tax the first carbon pricing scheme in Southeast Asia on January 1 2019. The carbon tax rate is set at SGP5 per ton of carbon dioxide equivalent emitted which is to apply until 2023.

Singapore was the first Southeast Asian nation to introduce a carbon tax in 2019 which is currently set at S5 369 per ton of greenhouse. 1 day agoSINGAPORE Feb 18 Reuters - Singapore will increase its carbon tax to S25 1860 a tonne in 2024 a five-fold increase from the current rate Finance Minister Lawrence Wong said on Friday in a. Estimation of reckonable GHG emissions.

1 day agoSingapore is the first country in Southeast Asia to implement a carbon pricing scheme the carbon tax was kickstarted on Jan. The carbon tax will incentivise emissions reductions across all sectors and support the transition to a low-carbon economy. In 2019 Singapore set the carbon tax at S5 per tonne.

Singapore was the first South-east Asian nation to introduce a carbon tax in 2019 but its rate of 5 per tonne is considered to be on the low end of the spectrum. The Carbon Tax 21. 22 hours agoSingapore was the first country in Southeast Asia to introduce a carbon pricing scheme implementing its carbon tax in 2019.

The carbon tax at S5 per tonne of greenhouse gas emissions tCO2e was introduced in 2019 through the Carbon Pricing Act CPA. 1 day agoThough Singapore was the first Southeast Asian nation to introduce a carbon tax the rate of S5 a ton was on the low end of the spectrum. Singapores GHG emissions 15.

The current rate of S5 per tonne on firms that emit at least 25000 tonnes of greenhouse gas was first implemented in 2019 making Singapore the. Singapores current carbon tax rate which will be in place until 2023 is 5 per tonne of emissions. The carbon tax is set at a rate of 5 per tonne of GHG emissions tCO2e from 2019 to 2023.

Singapore was the first country in Southeast Asia to introduce a carbon pricing scheme implementing its carbon tax in 2019. Singapores nationally determined contributions NDCs 14. The correct pricing will guide investment decisions and spur companies to decarbonise.

Revised carbon tax to be announced in 2022 Budget. Carbon price is one of the key levers for the green transition for Singapores economy. The countrys carbon tax applies to all facilities producing 25000 tonnes or more of greenhouse gas emissions annually which include oil refineries and power plants.

The carbon tax level is set at S5tCO 2 e in the first instance from 2019 to 2023 to provide a transitional period to give emitters time to adjust. It is applied uniformly to all sectors including energy-intensive and trade-exposed sectors without exemption. The revised rate for 2024 will be announced during next months Budget which will also indicate what to expect up to 2030.

Singapores carbon footprint II. 1 day agoHe also announced that the carbon tax rate in Singapore will be increased from the current S5 per tonne of emissions to between S50 and S80 by 2030 a move that will help the nation reach new more ambitious climate goals. Singapores carbon tax will be progressively increased to reach S50 to S80 per tonne of emissions by 2030 in order to meet the.

The countrys carbon tax applies to all facilities producing 25000 tonnes or more of greenhouse gas emissions annually which include oil refineries and power plants. 22 hours agoSingapore was the first country in Southeast Asia to introduce a carbon pricing scheme implementing its carbon tax in 2019. Singapore is the first country in Southeast Asia to introduce a carbon price.

This is at the low. 1 2019 at S5tCO2e. The carbon tax forms part of our comprehensive suite of mitigation measures by providing a broad-based price signal across the economy to achieve our climate targets.

From now till 2023 the carbon tax level will. Singapore must right-price resources through the carbon tax said Gan adding. SINGAPORE Reuters -Singapore will increase its carbon tax to S25 1860 a tonne in 2024 a five-fold increase from the current rate Finance Minister Lawrence Wong said on Friday in.

The aim is for emissions to dwindle to net-zero by or around 2050. A price range of about 40-80 a ton is needed to achieve the 2015 Paris Agreements main goal of limiting warming to 2 degrees Celsius 36 degrees Fahrenheit above preindustrial levels the report said. The countrys carbon tax applies to all facilities producing 25000.

What is the role of the carbon tax in Singapores mitigation strategy. SINGAPORE Singapores carbon tax will be raised to S25 per tonne of greenhouse gas emissions in 2024 up from S5 per tonne at present as the Government seeks to achieve net zero emission by. The 2017 budget on carbon tax and the 2019 implementation 22.

What are the advantagesdisadvantages of market-based instrument versus command and control tools.

Role Of Carbon Tax In Singapore S Mitigation Strategy 12 Download Scientific Diagram

Carbon Tax Consultancy Singapore Carbon Footprint Legal Requirements

Carbon Tax Impact On Electricity Customers Geneco

The Goldilocks Dilemma Of Singapore S Carbon Tax Opinion Eco Business Asia Pacific

Sembcorp Features

Government Climate Change In Singapore

Singapore Budget 2018 Carbon Tax What Does It Mean To Your Company The Logistics Academy Singapore Budget 2018 Carbon Tax What Does It Mean To Your Company

Commentary Why It Pays For Singapore To Be Much More Ambitious In Raising Carbon Tax Cna

2

Rs0h9eeia4vqhm

Government Climate Change In Singapore

Understanding Carbon Tax In Singapore Its Impact On Electricity Iswitch

Singapore Carbon Tax Set To Squeeze Oil Groups Financial Times

Singapore Launches South Asia S First Carbon Tax Access Cities

Big Emitters Face Carbon Tax From 2019 Business News Asiaone